Welcome to the official website of Shenzhen Yinsu Intelligent Technology Co., Ltd.

National Service Hotline:+8618927439160 / +86-755-84118220

Is smart wearable product a real market?

- Time of issue:2021-08-19

Is smart wearable product a real market?

(Summary description)American augmented reality company Magic Leap received Series C financing with a financing amount of up to 794 million US dollars. We must know that in 2015, the average financing amount after the B round of the wearable technology field was 220 million US dollars. What is particularly noticeable is that the lead investment company is Alibaba, and the companies that are involved in the investment include Google, Gaofeng Investment, J.P. Morgan, Morgan Stanley, etc.

- Time of issue:2021-08-19

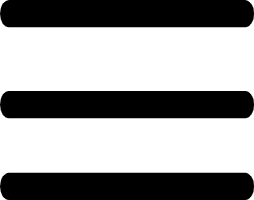

Magic Leap, an American augmented reality company, has received Series C financing with a financing amount of up to $794 million. We must know that in 2015, the average financing amount after the B round of the wearable technology field was US$220 million. What is particularly noticeable is that the lead investment company is Alibaba, and the companies that are involved in the investment include Google, Gaofeng Investment, J.P. Morgan, Morgan Stanley, etc.

The opposite of this is that after 2015, the wearable technology market as a whole is sluggish. The stock price of listed companies fell. Star companies like Jawbone, which raised 13 rounds of financing and were valued at $3 billion, are also closing product lines and emptying their inventory. Some people are questioning whether wearable devices are a real market?

Recently, Tiger Sniff compiled the latest "Smart Wearable Technology Report" produced by Tracxn, an investment analysis platform for Indian startups ). Based on the data provided and the company we know, take a look at the real situation in this industry. Is Ma Yun buying the company at the price of cabbage, or hitting the mirage with real money?

Trough period

From the perspective of the number of companies established, the amount of investment, and the operating conditions of representative companies, it is indeed a low period for the smart wearable industry.

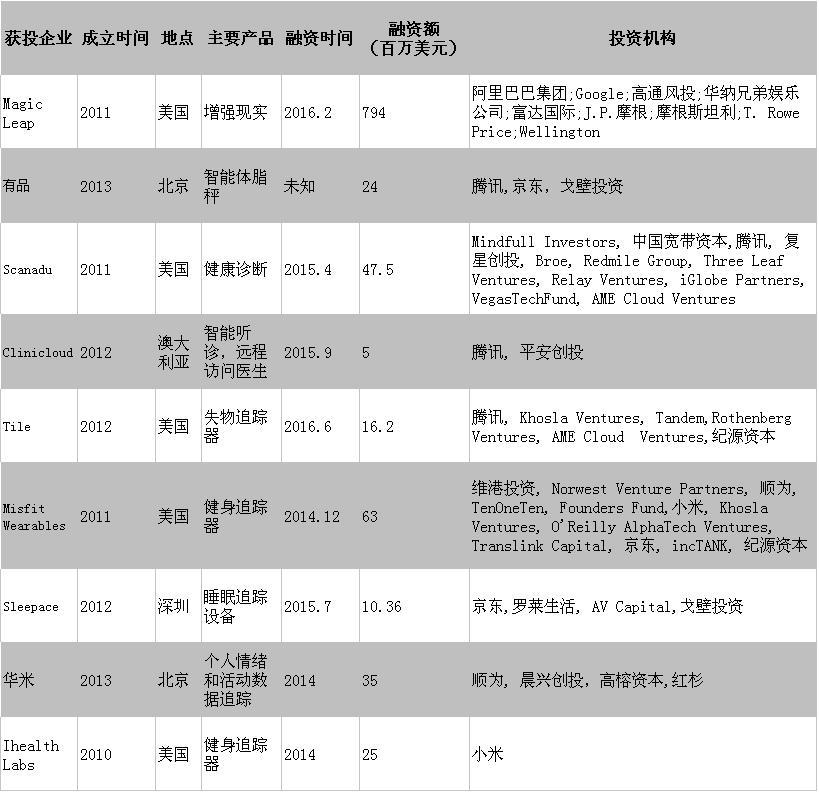

First, the number of companies established. According to the "Smart Wearable Technology Report" produced by Tracxn, most companies in this field were established in 2013-2014. The number of established companies dropped sharply after 2015.

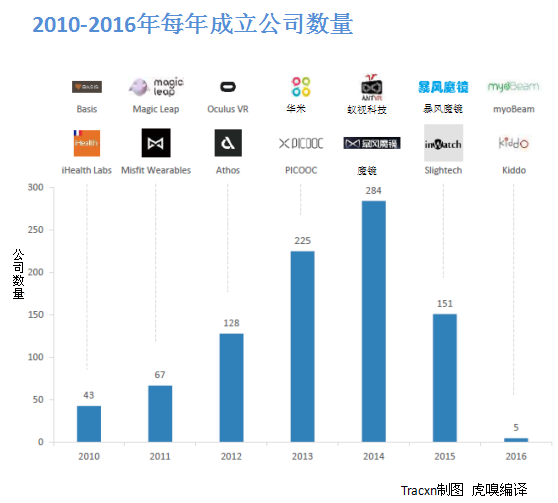

Secondly, the amount of investment. In 2014, the global investment in the wearable field reached US$1.417 billion, far higher than the US$1.073 billion in 2015. Just halfway through 2016, the total investment exceeded 2015, but this situation is not optimistic, because in February 2016 AR company Magic Leap received a C round of $794 million in financing, which raised the overall water level. If you ignore Magic Leap, the investment in the first half of the year is close to the data of the same period of the previous year, and industry investment is still on the low side.

Finally, it represents the business situation. Fitbit, the largest company in wearable health and fitness products, the main products are smart bracelets and watches , Listed in June 2015, the stock price trend after the listing is like this.

The decline in stock prices is not an isolated phenomenon. Among the 8 companies with the highest IPO market capitalization in the past three years, 7 have their stock prices down, and the only company that has gone up is Vuzix. , This is a company that makes VR products, we will talk about its situation later.

Jawbone, once the world’s second-most-selling smart bracelet company, is only behind Fitbit. In January 2016, Jawbone conducted its 13th round of financing, and its valuation has shrunk to $1.5 billion from the previous round of financing of $3 billion. In May 2016, Jawbone completely discontinued the production of the Up series of health tracking devices and sold all of its existing inventory to third-party distributors.

Current smart wearable technology, the second largest shipper is Xiaomi, which is familiar to Chinese readers. Xiaomi’s main products in the field of smart wear are bracelets and earphones. According to Tracxn's data, bracelet companies as a whole are going downhill, and those that have not yet closed down have switched to producing watches.

To analyze the causes of malaise, let’s first take a look at what kind of products are being made in the field of smart technology.

Main products

According to Tracxn’s "Smart Wearable Technology Report", from 2008 to 2016, there were 1045 wearable technology companies in the world, of which 345 have received investment and received investment amount The total is 5.326 billion U.S. dollars.

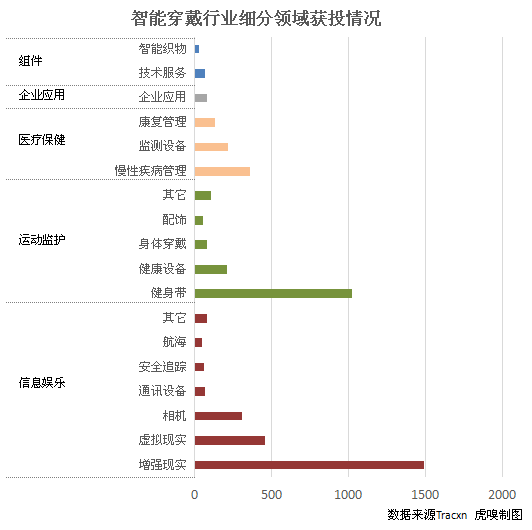

We divide our products into five main categories, namely infotainment, sports monitoring, healthcare, enterprise applications, and components. Then pick a few key segments to look at product development.

1. Mirage-like infotainment products

Infotainment products include wearable cameras, headsets, and security tracking devices, but currently the main investment areas are augmented reality (AR) and virtual reality (VR) Products.

Augmented reality products seamlessly integrate stereoscopic 3D images into real scenes, allowing real life and virtual worlds to interact. And virtual reality products will take us into a new virtual world. Once the two are mature and commercialized, they will change our study, life, work, and entertainment scenes. Welcome to the world of science fiction.

VR is considered to be the terminal form of the next-generation entertainment business. It is estimated that one million hardware devices will be shipped in 2016. Belongs to a few geek-level players. We hope that through iterations and mature VR technology, it will bring players a different time and space experience in which they are immersed and unable to extricate themselves.

Compared to VR, AR is more advanced. Google Glass and Microsoft Hololens are two typical AR products, which are highly anticipated. First of all, the price is too expensive, Google Glasses sells for $1,500, Hololens sells for $3,000. Then, it is uncomfortable to wear, and the weight is generally more than one pound. Also "hot head", because there is no room for heat dissipation due to high integration. The battery life is short, averaging 2-5 hours. The display area is small. The most deadly thing is that it can't give people a true feeling of being in nature, and various visual deviations can make the experiencer feel dizzy and nauseous.

On January 15, 2015, Google announced that it would stop selling the personal version of the first-generation Google Glasses and change it to enterprise first. Microsoft Hololens is still being sold as a geek product.

Over 35% of the investment in the wearable technology field each year is invested in the VR and AR fields. Google, Microsoft, Apple, Facebook, and Intel are all nurturing big moves in the VR and AR fields. They want to replace mobile phones and computers and occupy the lives of the public. That day is worth looking forward to, but the time is far from reached. For large-scale commercialization, Facebook included it in its ten-year strategy.

2. A motion monitoring product in the Red Sea

Such products include bracelets, watches, armbands, fitness clothes, etc. The main functions are nothing more than step counting, call reminder, heart rate, blood pressure, and sleep quality monitoring.

The low production cost of sports bracelets and weak technical barriers have brought in many competitors, making survival difficult. Most analysts attribute this collective survival difficulty to the cheap bracelets produced by Chinese manufacturer Xiaomi. The price of Xiaomi bracelet is only one-tenth of Fitbit and Jawbone bracelets, and it is currently the second largest manufacturer of bracelets in the field. In response to this accusation, Xiaomi's public relations person has said that it entered the US market late,Sales data is almost "ignorable".

In addition to competition, poor user stickiness also limits the overall size of the market. In a market research report conducted by Business Insider in 2015, 51% of users said that they did not see any need for use—iPhone has its own step counter and heart rate detection functions, and smart devices such as iPhone and Android meet the requirements. It meets the needs of the vast majority of users.

According to Tracxn’s "Smart Wearable Technology Report", currently smart watches< /a> has the highest sales revenue. Many companies that produce bracelets have already started, or plan to transform, to produce smart watches.

3. Medical and health care products that do not touch the ground

First of all, VR and AR are definitely not real markets at present.

Chinese enterprise layout: Jack Ma’s finishing touch

Baidu is absent from BAT companies.

Attachment: Main investment status of Chinese companies in the field of smart wear

Attachment: Representative companies in the global smart wearable field

National Service Hotline

+8618927439160

Phone:+8618138419185 / +8618927439160

Tel:+86-755-84118220

Mail:yinsukj@163.com

Address: Room 404, Longsheng Times Building, Gongye West Road, Longsheng Community, Dalang Street, Longhua District, Shenzhen

Official Account

Customer Service